FOR IMMEDIATE RELEASE

Lawmakers Prioritize Florida Resiliency, Storm Prep Measures

PIFF Thanks Lawmakers for Prioritizing Preparation and Mitigation Efforts

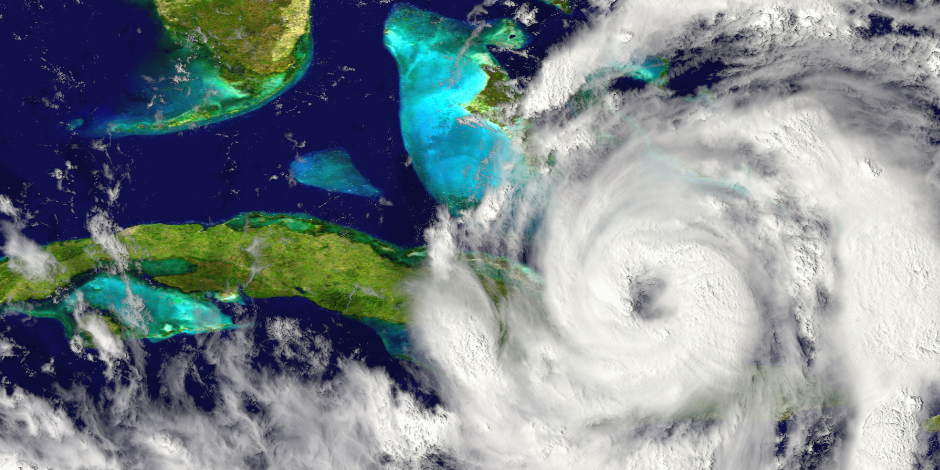

TALLAHASSEE, Fla. (March 11, 2022) – In a state vulnerable to rising seas and stronger storms, Florida lawmakers this Legislative Session prioritized measures that will help homeowners prevent windstorm damage by strengthening structures and help the state prepare an infrastructure more resilient to flooding.

STORM PREPAREDNESS TAX BREAKS

Today, the Senate considered the Conference Report (CR) for House Bill 7071, the annual legislative tax package. The bill, sponsored by Representative Bobby Payne in the House and Senator Ana Maria Rodriguez in the Senate, is up for a final vote on Monday. It provides broad tax relief for Florida taxpayers, including specific sales tax holidays.

The bill creates a 14-day “disaster preparedness” sales tax holiday from May 28 – June 10, 2022, for disaster preparedness supplies. It also creates a two-year sales tax exemption from July 1, 2022 – June 30, 2024, on the retail sales of impact-resistant windows, doors and garage doors.

Personal Insurance Federation of Florida (PIFF) President and CEO Michael Carlson praised continued efforts by lawmakers to prioritize the state’s resiliency and preparedness.

“Preparedness is the best insurance when it comes to storms in Florida,” said Carlson. “The work of hardening buildings to make them more impact-resistant can make a big difference, and we’re thankful lawmakers are lowering the cost of mitigation measures through the tax holiday. Disaster preparedness has been a huge priority of CFO Patronis, and we’re thankful to the CFO and to lawmakers for working hard to help homeowners lower their windstorm risk.”

RESILIENCY FOR STATE INFRASTRUCTURE

On Wednesday, the Legislature passed a bill which supports resiliency efforts for Florida’s communities and infrastructure amid rising sea levels. House Bill 7053 passed unanimously from the Florida Senate, its final stop before heading to Governor DeSantis. The bill builds on the 2021 achievements of Senate Bill 1954, which established several new programs and initiatives aimed at addressing the impacts of flooding and sea level rise on the state.

“A more resilient Florida will be beneficial to homeowners and insurance consumers,” said Carlson. “We’re grateful to Florida leaders for coming together to prioritize these efforts for the sake of our state’s future. This work will take data, funding and years of planning — lawmakers understand this along with Florida’s unique landscape and the challenges that make it more vulnerable to rising seas. Planning now will help protect Florida homeowners and help decrease the risks of future flooding.”

The resilience legislation was championed in the House this Session by Representatives Busatta Cabrera and Stevenson, and in the Senate by Senators Brodeur, Stewart and Rodriguez. HB 7053 establishes the Statewide Office of Resilience within the Executive Office of the Governor, which must be headed by the Chief Resilience Officer, appointed by the governor. Among several of the bill’s provisions, it authorizes the Department of Environmental Protection to provide grants from the grant program to a small city or county to fund pre-construction activities for projects submitted for inclusion in the plan. It also authorizes drainage districts, erosion control districts, regional water supply authorities and certain special districts to submit proposed projects for the plan under certain circumstances. The bill requires the hub to provide tidal and storm surge flooding data to cities and counties for vulnerability assessments that are conducted pursuant to the grant program. It also requires the Department of Transportation to develop a resilience action plan for the State Highway System based on current conditions and forecasted future events.

About PIFF

The Personal Insurance Federation of Florida, Inc. (PIFF), is a leading voice for the personal lines property and casualty insurance industry in Florida. PIFF represents national insurance carriers and their subsidiaries, including many of the state’s top writers of private passenger auto and homeowners multiperil insurance. Together, PIFF members write more than $13 billion in premium in the state. PIFF advocates for a healthy and competitive insurance marketplace for the benefit of Florida consumers. Follow us @PIFFNews. Visit PIFF.net to learn more.

# # #

Contact:

Allison Aubuchon, APR | 850.766.5255

communications@allisonaubuchon.com