New Infographics Break Down How and Why AOB Abuse is a Problem

TALLAHASSEE, Fla. (January 7, 2019) — The Personal Insurance Federation of Florida (PIFF) today released its 2019 legislative priority issues, which are intended to address challenges in the insurance markets and protect Florida insurance consumers. As the Florida Legislature convenes for its second committee week, PIFF announced six key issues the group hopes to address with the help of Florida lawmakers.

“With the holidays over and the inaugural imminent, we’re ready to work with our Governor and Cabinet and the Legislature to tackle important issues affecting Floridians,” said Michael Carlson, president of PIFF. “We must address some outstanding issues – like AOB and bad faith reform – that are festering in this state. We look forward to being a helpful resource to policymakers wanting information and thoughtful solutions to these issues, and we are excited to offer every tool we have to reach positive outcomes this year.”

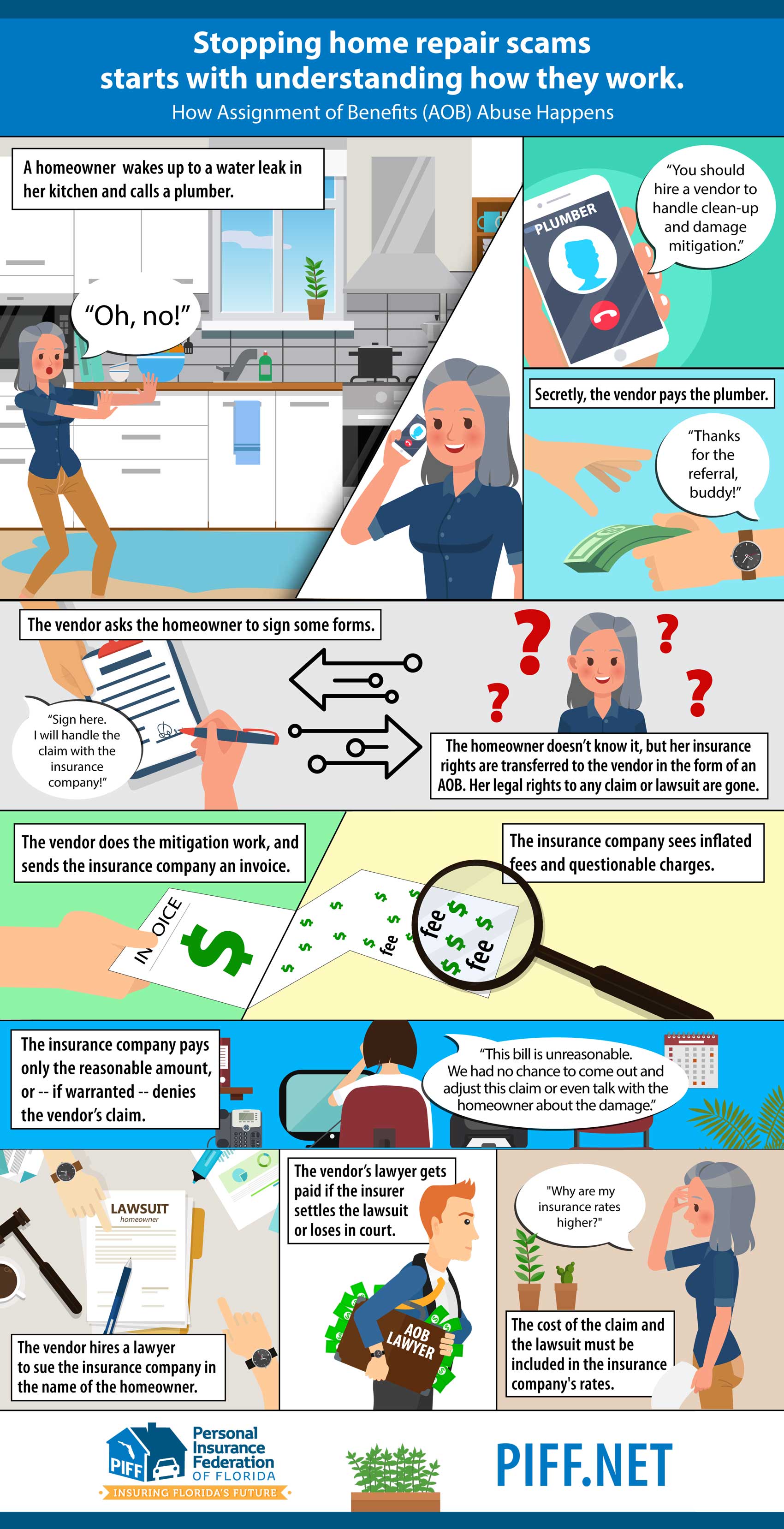

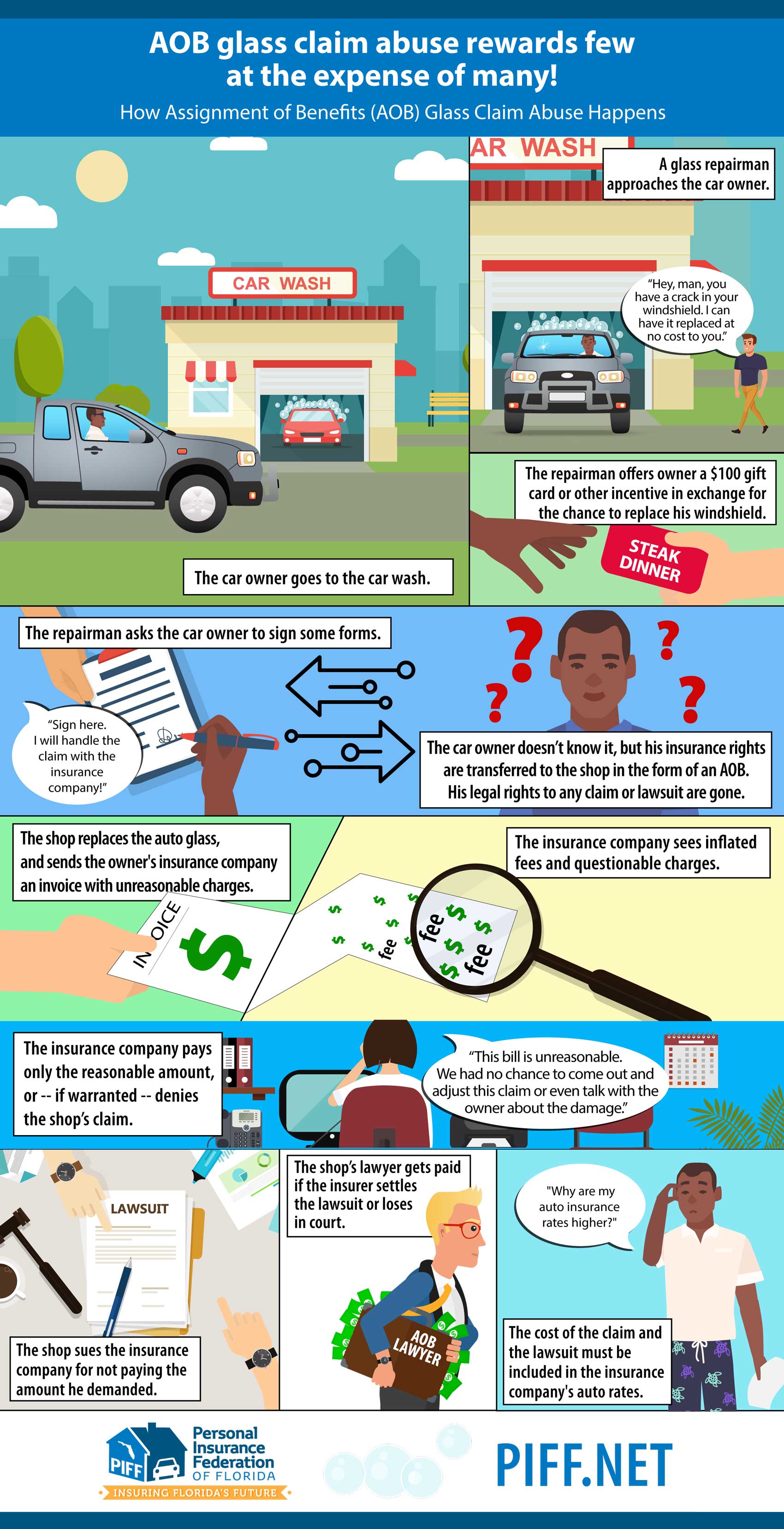

Among PIFF’s new communications tools are two infographics – released today – created to help

Floridians better understand how repair scams work.

PIFF’s 2019 Legislative Priorities:

Assignment of Benefits

PIFF supports changes to Florida’s “one-way” attorney fee law to restore it to its original purpose and require that businesses that take an assignment and then sue other businesses comply with the “American Rule” and pay their own lawyers. PIFF sees this as the best solution for reducing AOB abuse and the resulting increase in costs for consumers.

Auto Glass Claims Abuse

PIFF supports changes to eliminate automobile glass “harvesting” by unscrupulous vendors. Meaningful attorney fee reform would resolve this problem by removing the incentive for bad actors to engage in unscrupulous conduct.

PIP Repeal

PIFF opposes any repeal of the Motor Vehicle No-Fault Law that does not embrace key pro-consumer principles. Any repeal PIFF supports must include reforms to Florida’s deeply unfair insurance “bad faith” law, must avoid any artificial price controls, must not replace PIP with de facto PIP in the form of mandatory medical payments coverage, and must not increase mandatory bodily injury insurance coverage levels in a way that will increase insurance costs for consumers.

Online Verification of Insurance

PIFF supports streamlining Florida’s online verification of auto insurance system to improve the ability of law enforcement officers and the Department of Highway Safety & Motor Vehicles to determine whether a motorist has the required minimum insurance to operate a motor vehicle. This program would help reduce the number of uninsured motorists in Florida.

Third-Party Bad Faith

PIFF supports reasonable reforms to Florida’s deeply unfair third-party bad faith system. Today’s system creates a perverse incentive for claimants to “game” the judicial system to bypass policy limits and increase insurance coverage amounts. The current system encourages claimants to delay communication, withhold information and otherwise be uncooperative during attempts to settle a claim in the hope that the insurance company will make a mistake. This is effectively “claimant bad faith” and it results in millions of dollars in judgments – much of which ends up in trial lawyers’ pockets.

Autonomous Vehicle Insurance

PIFF supports federal regulation and state pre-emption with respect to autonomous vehicle safety issues. At the state level, PFF supports regulations regarding traffic and highway safety, driver and vehicle licensing and registration and insurance coverage requirements. PIFF does not believe that Florida law should dictate liability outcomes, as these should be determined by the courts. Finally, PIFF supports access to vehicle data for law enforcement, state and federal regulators, insurers and parties to a crash. Such data must not be excluded from insurance ratemaking or underwriting.

To learn more about the Personal Insurance Federation of Florida, visit PIFF.net.

About PIFF

The Personal Insurance Federation of Florida, Inc. (PIFF), is a leading voice for the personal lines property and casualty insurance industry in Florida. PIFF represents national insurance carriers and their subsidiaries, including many of the state’s top writers of private passenger auto and homeowners multiperil insurance. Together, PIFF members write more than $13 billion in premium in the state. PIFF advocates for a healthy and competitive insurance marketplace for the benefit of Florida consumers. Follow us @PIFFNews. Visit PIFF.net to learn more.

# # #