Reforms fuel Florida insurance revival

Reuters’ The Insurer, By Keria Wingate, Oct. 7, 2025

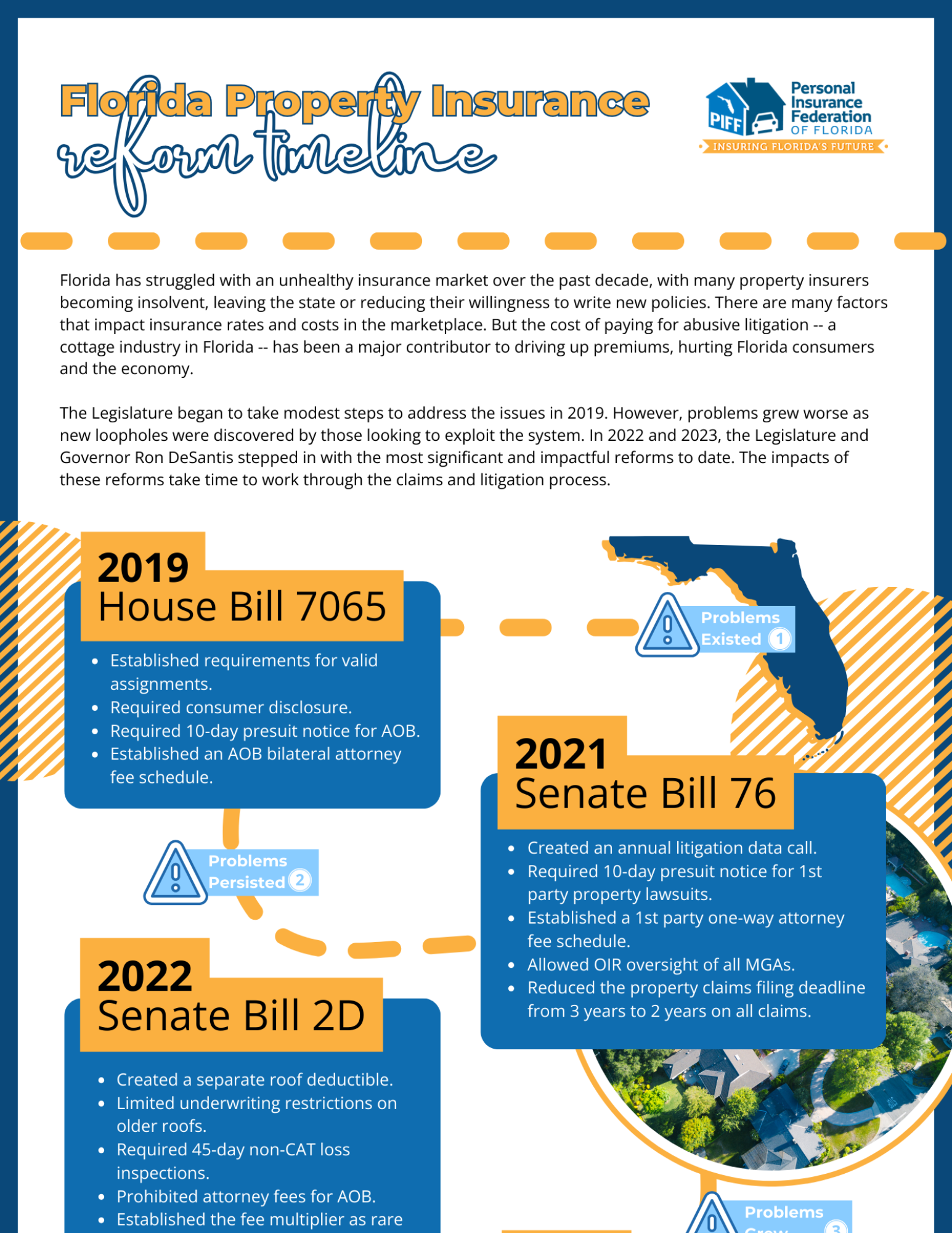

Florida’s property insurance market is showing signs of stability after years of volatility, with reforms passed in 2022 and 2023 credited with attracting new capital, curbing litigation and allowing Citizens to reduce its role as the state’s insurer of last resort.

Gov. DeSantis says reforms have improved homeowners insurance market

Florida Politics, by A.G. Gancarski, Oct. 6, 2025

“And then one of the largest insurers in the state, Florida Peninsula Insurance Company, has requested its largest rate decrease in recent memory. That would not have happened had we not done those reforms.”

Florida Chamber cheers on additional homeowner insurance companies coming to state

Florida Politics, by Drew Dixon, Sept. 2, 2025

“Removing the ‘get rich’ incentives for billboard and TV trial attorneys have already seen rates stabilize and drop recently. The leadership shown by Gov. Ron DeSantis and legislative champions will continue to pay off for hardworking Floridians across the state.”

Competition increases as 2 new property insurers start in Florida. What it means for you

Naples Daily News, by Anne Geggis, Aug. 27, 2025

But now, fortified by the state’s new rules that limit insurers’ exposure to lawsuits in policyholder disputes and better availability of catastrophic insurance capital, the tide has turned. Those 10 defunct insurers have been replaced, in addition to six more rounding out the offerings.

Property insurance reforms are working; Stay the course, Florida Legislature | Opinion

Miami Herald, by Mark Wilson, March 10, 2025

And just two years after these significant legislative reforms, the market is seeing 11 new insurance companies come to Florida and rates for families and businesses are stabilizing or starting to drop with the return of competition.

Florida vs. California Insurance, Round 2

Wall Street Journal, Feb. 17, 2025

States are laboratories for policy experimentation, and California’s insurance price regulations are blowing up in a big way. But Florida is showing that political leaders can head off a market disaster and lower costs if they have the courage to reform.

S&P study shows Florida had nominal increase in homeowners insurance rates

Florida Politics, Feb. 2, 2025

Homeowners insurance rates are rising across the nation, but despite more hurricanes striking the state, Florida remains relatively stable regarding rate hikes.

US homeowners rates rise by double digits for 2nd straight year in 2024

S&P Global, Jan. 21, 2025

“The states with the lowest calculated weighted average increase in 2024 were Nevada at 4.3%, Texas at 3.4% and Florida at 1.0%….Overall, the Florida homeowners market has seen improvement following legal reforms in 2023.”

Florida’s property insurance rates look to stabilize in 2025

Islander Media Group, Jan. 7, 2025

Citizens’ portfolio now holds less than 1 million policies, with 428,000 policies transferred to private market insurers in 2024, reducing Citizens’ exposure by nearly $200 billion.

Orlando insurance summit delivers hope for Florida’s property insurance marketplace

Spectrum News 13, Dec. 5, 2024

Insurance broker Michael Dehlinger, who has been selling insurance since 1987, said the governor’s insurance reform efforts, which included reducing lawsuits, is helping the industry and benefiting homeowners and brokers.

“You know, two, three years ago, we would have 10 quotes on homeowners, and eight of them were going to go Citizens,” Dehlinger said. “And we would only have two of them that would qualify somewhere else at a decent rate. Now were probably writing seven of them in the private market vs. three in citizens.”

Florida is the ninth largest insurance market in the country.

Louisiana insurance crisis: When will relief arrive?

Fox 8 Louisiana, Nov. 20, 2024

“We’re talking 18, 24 months before Florida started to see the changes and benefit from those changes. And I think that’s what Louisiana can expect as well,” said Temple.

Yaworsky says Florida’s tort reform has been impactful.

“I think the biggest thing in Florida has definitely been the tort reform. The one-way attorney fee, moving that to a contingency fee basis, like it exists in 49 other states, is to kind of create, restore rationality to that market, “said Yaworsky. “We want consumers to have access to legal assistance, but it should be a further along, last resort, not the first thing you reach for, it’s a good idea to give your insurer a shot.”

Milton won’t be a disaster for Florida’s insurance market, officials say

Tampa Bay Times, Oct. 10, 2024

“The marketplace is poised to weather the impacts of these storms effectively,” he added, pointing to recent reforms that include making it harder to sue insurance companies.

US P/C Insurance Industry Posts First H1 Underwriting Profit Since 2021

Insurance Journal, August 29, 2024

“After years of consistent losses, premium growth is helping the overall industry move towards stabilization, with positive first-half underwriting gains for the first time since 2021,” said Saurabh Khemka, co-president of underwriting solutions at Verisk, in a media statement announcing the figures released jointly by Verisk and the American Property Casualty Insurance Association (APCIA) yesterday.

Improved Florida insurance environment a “favourable market opportunity” – KBRA

Artemis, June 18, 2024

Rating agency KBRA has noted that the Florida property insurance market is now presenting a “favourable market opportunity” to those with the capital, capacity and legacy-free balance-sheets that can take advantage of it.

Florida property insurance market sees slight relief, per new report

CBS 12, May 23, 2024

Key findings from the OIR update include a decrease in rate filings by several insurance companies for 2024, as well as reductions in reinsurance costs. Additionally, there has been a significant shift of policies away from Citizens Property Insurance Corporation — dubbed the insurer of last resort — with approximately 389,000 policies transitioning to other insurers since January 2023.

3 Florida property insurance companies announce reduction in rates, desire to give homeowners some relief

News4Jax, April 15, 2024

Insurance experts call this move a glimmer of hope in an otherwise troubled insurance market in Florida. The reductions in property insurance premiums don’t equate to a whole lot of money, but they could mean a step in the right direction.

Homeowners insurance company to reduce rates by 2% for new customers, renewals

WPTV, April 10, 2024

“We’re very excited. We’re getting ready to reduce rates by 2% for our condominium and homeowners insurance customers,” Clint Strauch, president of Florida Peninsula Insurance, told WPTV…Strauch said a piece of legislation, Senate Bill 2A which passed in 2022, made this possible.

Florida Citizens: Capital markets “especially” positive for $5.5bn reinsurance renewal

Artemis.bm, April 8, 2024

Florida’s property insurer of last resort, Citizens Property Insurance Corporation, has said that its sees market conditions as especially positive in the capital markets, as it looks to progress its $5.5 billion reinsurance renewal for 2024.

Home insurance cost hikes slowed at the end of 2023. Some say the crisis may be nearing its end.

Sun Sentinel, April 8, 2024

A reduction in reinsurance costs, triggered by a decline in litigation and a mild year for hurricanes in 2023, will help to stabilize or even reduce homeowner insurance rates next year — if nature cooperates and spares us the cost and heartbreak of a major hurricane, Suarez-Resnick said.

Eight property and casualty insurers approved to enter market following legislative reforms

Florida Office of Insurance Regulation, April 3, 2024

“Florida’s insurance market continues to strengthen, showing signs recent legislation is having positive impacts to the property insurance market,” said Insurance Commissioner Michael Yaworsky. “OIR remains steadfast in our efforts to stabilize Florida’s insurance market by implementing legislative reforms and recruiting more insurers to the state. We look forward to continuing this work and promoting a competitive market for policyholders.”

April 1 reinsurance renewals more favourable to buyers: Aon

Reinsurance News, March 28, 2024

“The April 1st reinsurance renewals were more predictable and generally favorable to reinsurance buyers. As mid-year renewals get under way for the catastrophe-exposed markets of Florida, Australia and New Zealand, reinsurers are indicating a strong appetite for catastrophe risk,” said George Attard, CEO of Asia Pacific for Aon’s Reinsurance Solutions.

Florida: Reforms encourage carriers, drive property insurance market improvement

Artemis.bm, Feb. 28, 2024

The legislative reforms aimed at improving the property insurance market in Florida are increasingly seen as having a positive effect, with carriers increasing their appetite for writing in the state and analysts suggesting the benefits of the reforms could be significant over time.

6 new insurance companies approved in Florida as state looks to reduce Citizens Insurance policies

WPTV, Oct. 5, 2023

“A new set of insurance companies have been given approval to step in and make offers to take over Citizens Insurance policies in Florida.”

On insurance, we can’t lose sight of the policyholder | Jimmy Patronis

Sun Sentinel, by CFO Jimmy Patronis, Aug. 21, 2023

“… It will take time for these reforms to be fully realized within Florida’s insurance market, and to some degree, Florida’s challenges with insurance may have been the canary in the coal mine for the rest of the United States. According to the Wall Street Journal, 31 states have had double digit rate increases since the beginning of 2022. Louisiana had a special session to deal with their insurance crisis, policyholders in Texas are facing huge premium hikes, and California’s got companies who are withdrawing or refusing to write new policies. As Florida’s changes take hold, the Legislature has to ensure we don’t lose sight of the policyholder.”

The Capitolist, Aug. 15, 2023

“The addition of Mainsail Insurance Company to the Florida market is evidence that recent legislative reforms are having a positive impact for consumers,” said Insurance Commissioner Michael Yaworsky.

Florida insurance market continues to grow, regulator says

Insurance Business, Aug. 15, 2023

Mainsail joins Tailrow, which received OIR approval in April. The OIR is actively accepting and reviewing applications and will announce new entrants on an ongoing basis.

Private insurers set to take thousands of Citizens policies. Here’s why it matters

Click Orlando, Aug. 2, 2023

Cotton says more private carriers showing that they are willing to take on more risk is proof that the fixes the legislature put in place during the last legislative session are actually beginning to work.”

Slide backed to pick up 100,000 Florida Citizens policies

Insurance Business America, Aug. 1, 2023

“We view this as a big opportunity to grow our footprint in Florida,” Slide CEO Bruce Lucas told Insurance Business… We do think that the market is at a turning point,” Lucas said. “The legislation from December, we think is working, we think that the future is very bright as a result of that. It’s given me the confidence to grow and expand in Florida.”

Universal encouraged by Florida claims & litigation environment after reforms: CEO

Artemis.bm, July 28, 2023

Universal Insurance Holdings, the Florida headquartered primary insurance carrier, believes that there are now signs of an improved claims and litigation environment in the state, after the enactment of the legislative property insurance reforms.

State Farm recommits its coverage in Florida amid environmental risks

NewsNation, July 25, 2023

“State Farm plans to continue our substantial presence in the Florida insurance marketplace. Our current plans include a commitment to responsible growth so that we can maintain the financial strength to deliver on our promises to our customers,” State Farm spokesperson Roszell Gadson said in a statement. “We are encouraged by the recent insurance reforms and efforts to curb legal system abuse and we will continue to work constructively with the Florida Legislature and the Office of Insurance Regulation to improve the marketplace on behalf of our Florida customers.”